Budget Review October 2022–23 Index

Gregory O’Brien

In Australia, and in countries around the world, government

economic support packages in response to the COVID-19 pandemic have led to

large increases in government debt. This continues the trend of increasing debt

since the Global Financial Crisis (GFC). Since the beginning of the pandemic, Australian

Government gross debt has increased from $534.4 billion in March 2019 to $894.9 billion as of 28 October 2022. The

October 2022–23 Budget forecasts further increases in gross debt to $1.159

trillion (43.1% of GDP) by the end of the 2025–26 financial year (Budget strategy

and outlook: budget paper no. 1: 2022–23,

p. 218). While these are the highest levels of debt on issue by the Australian

Government since the 1950s, they remain well below both Australian

historical peaks reached following the Second World War (p. 8) and

current government debt levels held by governments in other developed

countries.

Key terms are outlined below, followed by an overview of

Australian Government debt figures in the Budget based around 3 frequently

asked questions: how do current levels of Australian Government debt compare to

the past; how they compare internationally; and who owns Australian Government

debt. A final section highlights where to find more detailed discussions of

debt in the Budget.

Australian Government debt issuance and key terms

Australian Government debt is a key component of the

Australian Government Budget. Government spending is funded either through

receipts—primarily taxes—or through borrowing. In the Budget, the difference

between receipts and payments is referred to as the cash balance, which has

been in deficit (payments have exceeded receipts) since 2007–08. The Budget

estimates that the underlying cash balance will be $36.9 billion (1.5% of GDP)

in deficit in 2022–23 and will remain in deficit throughout the next decade

through to 2032–33 (Budget paper

no. 1, pp. 74; 81). These deficits have led to a steady increase in the

level of Australian Government debt, which is forecast to continue rising over

the next decade.

The Australian Office of

Financial Management (AOFM) manages Australian Government debt issuance.

The AOFM issues 3 types of debt securities, collectively known as Australian

Government Securities (AGS):

Treasury Bonds: medium to long-term debt securities

that pay interest at a fixed annual rate every 6 months. These are the largest

type of AGS, representing 92.8% of AGS on issue as of 28 October 2022.

Treasury Indexed Bonds: medium to long-term debt

securities that include adjustments for inflation. These represented 4.2% of

AGS on issue as of 28 October 2022.

Treasury Notes: short-term debt securities with

maturations up to one year. These represented 3% of AGS on issue as of 28

October 2022.

The total face value of AGS on issue at a given point in

time, which represents the total amount that will need to be repaid when all

extant AGS mature, is used as a measure of gross debt in the Budget. The AOFM publishes a weekly figure for total

AGS on issue, broken down into the 3 types described above, as well as more

detailed information in its data hub.

While gross debt is a good representation of the total

magnitude of outstanding debt, it may not be the best measure for analysing

debt sustainability depending on the financial assets available to service or

pay off this debt. For this reason, the Budget also provides figures for

Australian Government net debt, defined as ‘the sum of interest-bearing

liabilities less the sum of selected financial assets (cash and deposits,

advances paid and investments, loans and placements)’ (Budget paper

no. 1, p. 223). These financial assets are primarily held in government

investment funds, such as the Future Fund.

Whether gross debt or net debt is a better measure of

government indebtedness will depend on the context of the analysis. The

difference between these measures is described in more detail when looking at

international comparisons of government debt, below.

Trends in Australian Government Debt

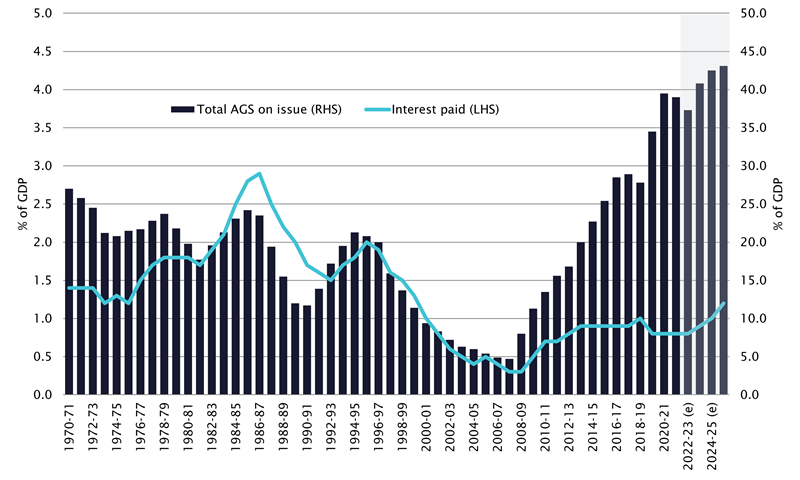

The

Budget provides historical data for a range of budget aggregates back to

1970–71 in the Historical Australian Government Data statement of Budget paper

no. 1 (Statement 11). When

comparing levels of debt across long periods of time, it is useful to convert

the dollar values of debt into a relative measure, usually the ratio to GDP, to

control for the impacts of price changes across the economy. Figure 1 shows

gross debt, represented by the total face-value of AGS outstanding, as a ratio

to GDP over the last 50 years and including Budget estimates through to 2025–26.

It also shows the interest payments on this debt for the same period, also as a

ratio to GDP.

Figure 1 Australian

Government total AGS on issue (gross debt) and interest paid

Source: Budget paper

no. 1, p. 382.

Figure 1 shows that Australian Government debt fluctuated

around 20% of GDP from the early 1970s to the mid-1990s with one period of sustained

decreases in the late 1980s. Government debt then trended down between the

mid-1990s until the GFC in 2007–08, as the Howard Government prioritised debt

repayment and budget surpluses. From 2008–09 in the wake of the GFC and

associated government economic support packages, government debt has steadily

increased as a ratio to GDP. The October 2022–23 Budget forecasts government

debt to GDP to fall in 2021–22 and 2022–23 as nominal GDP growth increases at a

higher rate than gross debt, but increase again from 2023–24 (Budget paper

no. 1, p. 382). In dollar terms, gross debt is forecast to increase to reach

a trillion dollars in 2023–24, reaching a peak over the forward estimates of

$1.186 trillion in April 2026 (Budget paper

no. 1, p. 218). While current and forecast debt to GDP ratios are high

relative to recent history, they are still well

below the peak reached following the Second World War of over 120% of GDP (p. 8).

The increase in the level of Australian Government debt following

the GFC had not seen a commensurate rise in the amount of interest paid because

interest rates on Australian Government debt fell over the period, largely

offsetting the increase in the level of debt. Interest rates on

Australian Government debt have risen steeply throughout 2022, however.

This increase has been common to many countries globally in response to

inflationary pressures and tightening of monetary policy by central banks. This

increase in interest rates has led to an increase in the estimates for Australian

Government interest payments as a proportion of GDP, which are estimated to

increase from 0.8% of GDP in 2022–23 to 1.2% of GDP in 2025–26. The Budget

provides a discussion of the impact of higher interest rates on the budget in

Box 3.4 on pages 84–85 of Budget

paper no. 1.

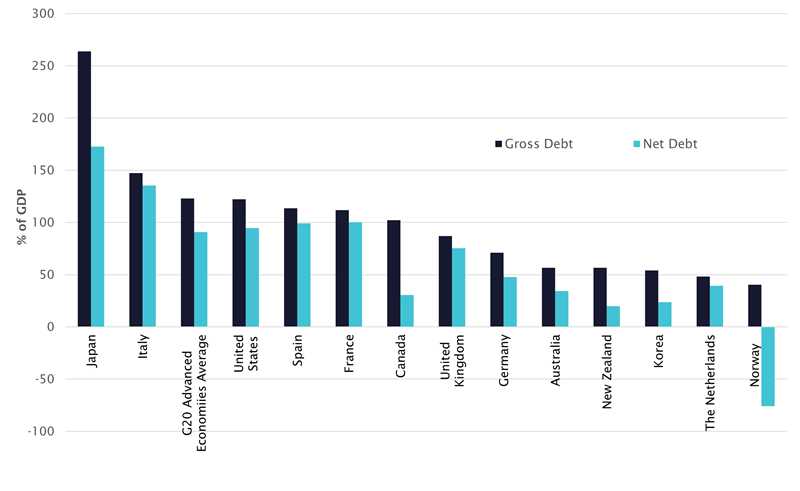

International comparison of General Government debt

Despite increases in Australian Government gross and net

debt since the GFC, levels of both remain relatively low when compared to other

countries. The International Monetary Fund (IMF) publishes data on General

Government sector gross and net debt across countries. The IMF approach

includes all levels of government (Australia Government, state and local

governments), which allows more meaningful comparison across countries with

different structures of government. Figure 2 shows IMF estimates of gross debt

and net debt for 2022 across several advanced countries from the IMF’s Fiscal

Monitor October 2022 publication.

Figure 2 IMF General Government gross and net debt

(% of GDP) estimates, 2022

Source: International Monetary Fund (IMF), Fiscal

Monitor: Helping People Bounce Back (Washington, DC: IMF, October 2022),

Tables A7 and A8.

Figure 2 shows the important difference between gross debt

and net debt when comparing across countries. Countries with significant

financial assets, such as Canada (held by public pension plans) and Norway

(held in a sovereign wealth fund) have much lower levels of net debt than gross

debt once these financial assets are incorporated. This is also relevant to a

lesser extent for Australia, where the $242 billion in the Future Fund and other smaller

government investment funds have contributed to a

widening gap between gross debt and net debt over time (p. 1).

There is variation across countries in the degree to which

these financial assets are held to meet future specified expenditure purposes,

and some debate as to whether it is appropriate to consider these assets as

offsetting government debt. Gross debt is a more consistent measure across

countries, as there is less variation due to different social security regimes.

As Figure 2 shows, despite the increase in both Australian

Government net debt and gross debt since 2007–08, the level of government debt

compared to international peers remains relatively low. The Australian General Government

gross debt to GDP ratio is less than half that of the United States, and less

than a quarter that of Japan. Both gross debt to GDP and net debt to GDP ratios

are lower than any G7 members, and closer to mid-sized economies including

Korea and New Zealand.

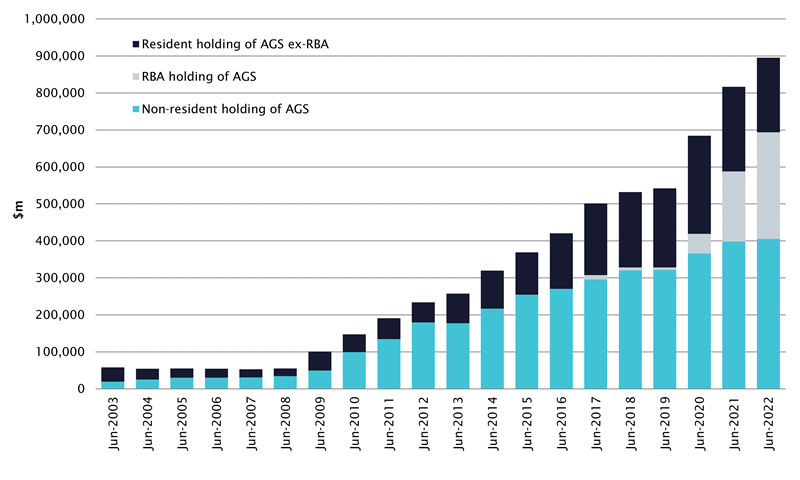

Holdings of Australian Government Securities

Australian Government debt is owned by a range of Australian

and international investors. The AOFM provides information on the share of AGS

on issue owned by non-residents on a market-value basis. Under the Guarantee of State and

Territory Borrowing Appropriation Act 2009, the AOFM was tasked with

establishing a Public

Register of Government Borrowings. As the AOFM has no powers to compel

financial intermediaries to disclose the beneficial owners of AGS they

administer, the register has limited information on the countries of residence

of foreign owners of AGS.

The Reserve Bank of Australia (RBA) started purchasing

significant amounts of AGS on the secondary market as

part of its monetary policy response to the COVID-19 pandemic in order to

lower yields on government bonds and maintain liquidity in bond markets. This

led to the RBA holding a growing share of the total AGS on issue. The RBA

ceased purchasing AGS on 10 February 2022, and in its May 2022 Statement

on Monetary Policy decided that:

[…] the Board will not reinvest the proceeds of maturing

government bonds and expects the Bank’s balance sheet to decline significantly

over the next couple of years as the Term Funding Facility comes to an end. The

Board is not currently planning on selling the government bonds that the Bank

has purchased during the pandemic. (p. 3)

This decision means that RBA ownership of AGS should slowly

recede as the existing AGS owned by the RBA mature. As total outstanding AGS is

not forecast to decline, these maturing bonds will need to be absorbed by the

resident and non-resident markets for AGS. Given the duration of these bonds,

this process is likely to slowly occur over the next decade.

Figure 3 below shows estimates for the ownership of AGS by non-residents,

the RBA and other domestic owners. The chart shows resident holdings of AGS

have steadily increased over the last decade and non-resident holdings have

fallen as a proportion of the total while RBA holdings have increased over the last

2 financial years. The reduction in the proportion of AGS held by non-residents

reduces the risk of interest rate volatility associated with capital flight,

when non-resident investors sell overseas assets and repatriate the money,

often in response to market volatility.

Figure 3 Estimated resident, Reserve Bank Australia

and non-resident holdings of AGS

Source: Parliamentary Library calculations based on Australian

Office of Financial Management, Non-resident

holdings of AGS, and Reserve Bank of Australia, Holdings of Australian

Government Securities and Semis.

Where to find additional discussion of debt in the October 2022–23 Budget

While this article provides a broad overview of the debt

figures contained in the Budget, more detailed discussion is provided on

several debt-related topics in Budget paper no. 1:

- Budget paper

no. 1 – Statement 3: Fiscal Strategy and Outlook provides the medium-term

(through to 2032–33) projections for the underlying cash balance (p. 81), gross

debt (p. 97) and net debt (p. 100), and how these projections have changed

since the Pre-election Economic and Fiscal Outlook 2022 (PEFO).

- Statement 3 includes a discussion of how changes in

productivity growth, government debt yields and NDIS costs since PEFO have impacted

medium-term projections for the underlying cash balance and gross debt (Box

3.2, p. 82).

- Statement 3 also provides a discussion on the impact of

higher interest rates on the budget, including their impact on government

interest payment projections (Box 3.4, pp. 84–85).

- Statement 7: Debt Statement provides detailed figures on

Australian Government debt parameters over the forward estimates (to 2025–26).

- a complete breakdown of Treasury Bonds on issue is provided in

Table 7.4, p. 220.

- yield curve assumptions (interest rate assumptions for Treasury

Bonds of different maturities) used in the Budget and how they have changed

since the March 2022–23 Budget are provided on page 225.

- Statement 8: Forecasting Performance and Sensitivity Analysis

discusses how changes in underlying assumptions impact key budget forecasts. The

sensitivity analysis for movements in yields (pp. 246–248) shows how

alternative assumptions of 10-year bond yields would lead to different

assumptions for the path of gross debt levels.

All online articles accessed October 2022

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth Coat of Arms, and to the extent that copyright subsists in a third party, this publication, its logo and front page design are licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia licence.

In essence, you are free to copy and communicate this work in its current form for all non-commercial purposes, as long as you attribute the work to the author and abide by the other licence terms. The work cannot be adapted or modified in any way. Content from this publication should be attributed in the following way: Author(s), Title of publication, Series Name and No, Publisher, Date.

To the extent that copyright subsists in third party quotes it remains with the original owner and permission may be required to reuse the material.

Inquiries regarding the licence and any use of the publication are welcome to webmanager@aph.gov.au.

This work has been prepared to support the work of the Australian Parliament using information available at the time of production. The views expressed do not reflect an official position of the Parliamentary Library, nor do they constitute professional legal opinion.

Any concerns or complaints should be directed to the Parliamentary Librarian. Parliamentary Library staff are available to discuss the contents of publications with Senators and Members and their staff. To access this service, clients may contact the author or the Library‘s Central Enquiry Point for referral.