Budget Review October 2022–23 Index

Elo Guo-Hawkins

Introduction

In Budget October 2022–23,

the Australian Government projects

a

large and persistent structural deficit (p. 81), against a backdrop of looming

overseas recessions, natural disasters at home, war in Europe, a slowdown in

China, an energy crisis, high inflation and rising interest repayments on

national debts. The Budget depends heavily on personal

and company income taxation, comprising on average 66% of all revenue over

the forward estimates. (The remaining 34% revenue consists of the goods and

services tax, excise and customs duty, superannuation, some minor indirect

taxes and non-tax revenue.) The Australian Government confirms its election

promises to initiate a multinational tax integrity package and extend existing

compliance programs (p. 7) to raise revenue by addressing an existing tax gap.

This paper discusses major ‘tax gap’ measures in the Budget

and points out that although addressing the tax gap is a welcome start, it alone

won’t be sufficient to repair the structural deficit.

What is the ‘tax gap’?

The Australian

Taxation Office (ATO) defines a ‘tax gap’ as:

an estimate of the difference between

the amount of tax the ATO collects and what the ATO would have collected if

every taxpayer was fully compliant with tax law.

Tax gaps are about measuring what is not directly observable

– what people have not told us.

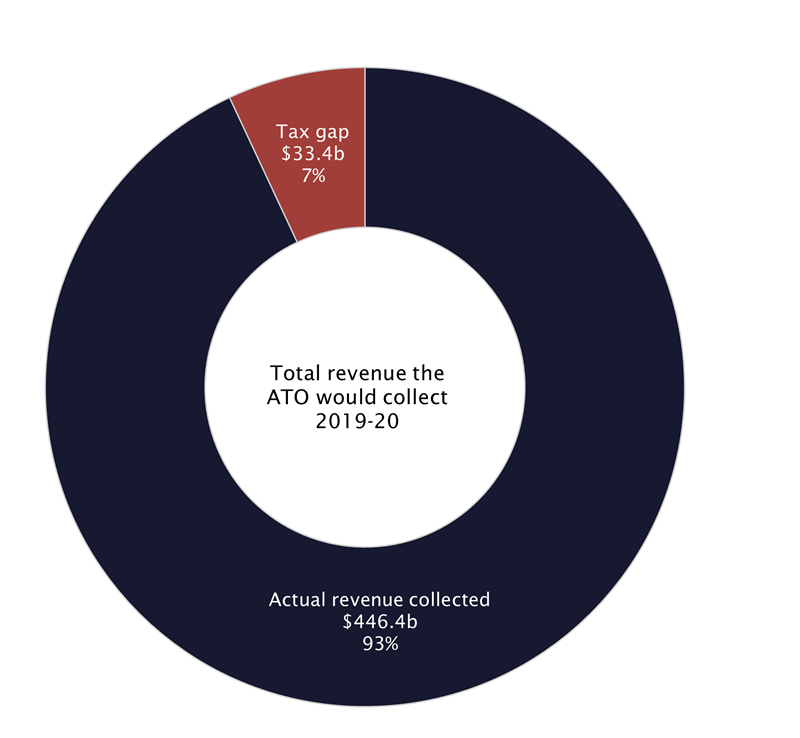

Our latest tax gap estimates show that for 2019–20, we

received $446.4 billion or 93% of the $479.8 billion we would collect if

everyone was fully compliant with tax law.

We collect most of this tax voluntarily, reflecting a system

that is operating well. This means that the overall tax gap for 2019–20 is

estimated to be $33.4 billion, or 7% of the tax that should have been reported.

Figure 1 illustrates the scale of the tax gap, relative to

all collected taxes, according to ATO calculations. To be clear, the tax gap

does not include revenue foregone in the form of ‘tax

expenditures’, that is, tax concessions or exemptions applying to

particular activities or classes of taxpayer (for example, the exclusion of

personal homes from capital gains tax).

Figure 1: Comparing taxation

revenue collected and tax gap in 2019–20 ($b)

Source: Parliamentary Library calculations based on numbers

reported in ATO

2021-22 annual report, p. 64.

Causes of tax gaps identified throughout Budget

October 2022–23: Budget paper no.2 include: tax avoidance practices used

by multinational entities (MNEs), large Australian businesses and wealthy

individuals; individuals’ non-compliance; shadow economy activities; and tax

practitioners providing poor or unlawful advice. These behaviours impact all

Australians, undermining the integrity of Australia’s tax and welfare systems,

and creating an uneven playing field.

Major Budget receipt measures

addressing the tax gap

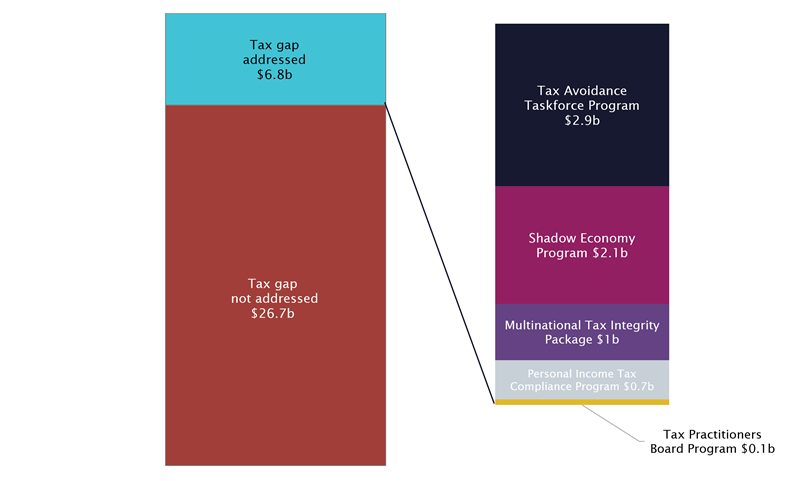

Table 1 quantifies measures in Budget

paper no. 2 that address the tax gap. Overall, the measures are

expected to raise $6.6 billion in tax receipts over the forward estimates. In

other words, they are expected to reduce 20% of the 2019-20 tax gap.

Table 1 Major receipt measures

addressing the tax gap ($m)

|

|

2022–23

$m

|

2023–24

$m

|

2024–25

$m

|

2025–26

$m

|

Total $m

|

| Multinational Tax Integrity Package |

|

|

|

|

|

| – Element

1: Amending Australia’s thin capitalisation rules |

- |

- |

370 |

350 |

720 |

| – Element

2: Denying deductions for payments relating to intangibles held in low or no

tax jurisdictions |

- |

40 |

110 |

100 |

250 |

| – Element

3: Improving tax transparency |

* |

* |

* |

* |

* |

| Subtotal |

0 |

40 |

480 |

450 |

970 |

| Extending ATO and Tax Practitioners Board Compliance

Programs |

|

|

|

|

|

| – Personal

Income Taxation Program |

- |

151 |

287 |

236 |

674 |

| – Shadow

Economy Program |

- |

404 |

714 |

941 |

2,059 |

| – Tax

Avoidance Taskforce |

277 |

535 |

729 |

1,309 |

2,850 |

| – Program

to enhance tax system integrity |

- |

9 |

25 |

48 |

82 |

| Subtotal |

277 |

1,099 |

1,756 |

2,533 |

5,665 |

| Grand Total |

277 |

1,139 |

2,236 |

2,983 |

6,635 |

* The nature of the measure is such that a reliable estimate

cannot be provided. - Nil.

Source: Australian Government, ‘Part

1: Receipt Measures’, Budget Measures: Budget Paper No.2: October 2022–23,

Table 1 Receipt Measures since the 2022 PEFO, pp. 4-5.

Assuming the $33.4 billion tax gap estimate in 2019–20 is

still correct as of current, Figure 2 illustrates that 80% of the gap (or $26.7

billion) remains unaddressed even after applying the Budget measures to address

the gap.

Figure 2 An illustration of

remaining $26.7b tax gap after applying the measures ($b)

Source: Parliamentary Library calculations based on numbers

reported in ATO

2021–22 annual report, p. 64 and Budget

Measures: Budget Paper No.2: October 2022–23, Table 1 Receipt

Measures since the 2022 PEFO, pp. 4-5.

Closing the Tax Gap: Multinational

Tax Integrity Package

The Multinational

Tax Integrity Package (MTIP) delivers on the Australian Government’s

election promise, as well as Australia’s long-term commitment to implement the

Organisation for Economic Co-operation and Development (OECD) Base Erosion and Profit

Shifting (BEPS) 15 Actions.

BEPS refers to the tax planning strategies used by MNEs to exploit gaps and

differences between tax rules of different jurisdictions internationally. The

OECD conservatively estimates the global

annual

revenue loss due to BEPS at US$100 to $240 billion. Following

the

G20 finance ministers’ request in 2013 to address the BEPS issues in a

coordinated and comprehensive manner, the OECD released a final BEPS Actions

package in 2015. (See Appendix A for a status on the

Australia’s BEPS plan implementation.)

The MTIP is expected to reduce the tax gap by around $970

million over the forward estimates, which is lower than the election estimate

of $1.9

billion (ECR167). The downward revision is mainly

due to the Treasury’s taking account of the substituted accounting periods for

the change in the thin

capitalisation rule (MTIP element 1) and the cumulative

effect of other minor changes in policy specifications such as revising down

the corporate tax rates from ‘below

24%’ (p. F-242) to ‘less

than 15%’ (p. 16) for MNEs claiming

deductions relating to intangible assets (MTIP element 2).

The MTIP consists of three elements, which are expected to

commence on or after 1 July 2023. Although Treasury completed a

public consultation on the package in September 2022, final details are yet

to be released. The ATO provides a

summary of the proposed changes for each

element.

MTIP Element

1 amends Australia’s existing thin capitalisation rules to align with OECD’s

best practice approach under Action

4. It affects most MNEs operating in Australia currently subject to thin

capitalisation rules with at least $2 million in debt deductions.

Australia’s thin capitalisation rules limit ‘debt

deductions’ for interest expense and borrowing costs where the debt-to-equity

gearing ratios must be within the prescribed debt limits. The maximum debt

allowed is calculated by one of three tests, namely, the ’safe

harbour’ (an objective level of debt an entity can use to fund the assets

used in its Australian operations), ‘arm’s-length’,

and the ‘worldwide

gearing’ (the Australian operations of certain entities can be geared up to

the level of gearing of the entity’s worldwide group). Entities are allowed to

choose the test that gives the highest deduction and is the easiest to apply.

In 2014, the

OECD reported (p. 19) some thinly capitalised

MNEs (whose assets are funded by a high level of debt and little equity) shift

their profits to lower tax countries and minimise taxable income by way of

excessive interest payments to foreign affiliated companies. To address the

issue, the OECD BEPS initiatives may tighten the current rules, affect the debt

limits, and lead to a lowering of tax deductions in Australia by a combination

of narrowing the scope of arm’s length debt limit and reducing the safe harbour

ratios.

As

the ATO explains, the ‘safe harbour’ test is expected to be replaced with

an earnings-based test so that: debt-related deductions exceeding 30% of

earnings before interests, taxes, depreciation and amortisation (EBITDA, a

measure of profits) will be disallowed and carried forward for up to 15 years;

the ‘worldwide gearing’ test will be replaced with an earnings-based group

ratio rule; and the ‘arm’s-length’ test will be amended to only allow an

entity’s third-party debt deductions (while disallowing related party debt

deductions).

MTIP Element

2 denies significant global entities (SGEs)—with global revenue of $1

billion or more— from claiming deductions for payments relating to intangible

assets and royalties held in a low or no tax jurisdiction, which have either ‘a

tax rate of less than 15%, or a tax preferential patent box regime without

sufficient economic substance’(p. 16). In

the 2021–22 Budget, the Coalition Government announced it would establish a

patent box tax regime in Australia and introduced a bill to the Parliament.

The bill

lapsed with the dissolution of the 46th Government. The Australian

Government confirmed its intention to legislate this regime by not removing the

patent box measure from the Budget

March 2022–23 (pp. 22-24).

Element 2 addresses problems involving MNEs shifting profits

of highly mobile intangible assets to tax havens. This profit shifting trend is

exacerbated by the increasing digitalisation and globalisation of the economy. The

related Action

5 introduces new rules to constrain eligibility requirements for a patent

box, including a requirement for sufficient economic substance in the

jurisdiction with the intangible assets. For example, deduction claims for

Patent Box expenses will be denied in a jurisdiction (for example, a tax haven)

where economic substance is lacking.

MTIP Element

3 improves tax transparency by introducing reporting requirements for

relevant companies to enhance the tax information they disclose to the public. SGEs

will be required to prepare for public release of certain tax information on a

country-by-country basis (Action

13) and a statement on their approach to taxation, for disclosure by the

ATO. Australian public companies (listed and unlisted) will be required to

disclose information on the number of subsidiaries and their country of tax

domicile.

The October Budget package also complements another

Australian Government election announcement in supporting the OECD’s ‘Two-Pillar

Solution’ for a global 15% minimum tax, and ensuring profits of the largest

multinationals (such as Alphabet, Amazon, Meta, Microsoft and Apple) are taxed

where the products or services are sold. This Budget does not contain a ‘Two-Pillar

Solution’ measure.

Closing the Tax Gap: Domestic measures

Certain ATO and Tax

Practitioners Board compliance programs are extended with additional

government funding. These programs are briefly discussed below.

Personal Income Taxation Program

This program is expected to close the tax gap by $674.4

million over the forward estimates. It will focus on key non-compliance areas such

as individuals overclaiming deductions and misreporting income. The ATO’s

Second Commissioner re-raised the issues in

October 2022 (p. 4):

we estimate that individuals are correctly paying about 94%

of the tax they should be at lodgement … [Work related expense] claims account

for almost $4 billion of the individuals not in business tax gap – or 44%. So

many claims are an optimistic characterisation of personal expenses as work

related, while others are even more creative claims … [The ATO estimates] the

portion of the tax gap for 2018–19 attributable to unreported income was over

$1 billion … Currently rental income and deductions contributed over $1 billion

to the net tax gap. In the 2020–21 tax return (as of 30 June 2022), over 2

million rental property owners declared over $45 billion in income and about

$43 billion in expenses. The Random Enquiry Program that helped determine this

estimate showed that 9 out of 10 returns reporting net rental income required

adjustment. This is startling and clearly something we need to address.

Shadow Economy Program continuation

The program is expected to reduce the tax gap by $2.1

billion over the forward estimates.

The ‘shadow

economy’ refers to dishonest and criminal activities that take place

outside the tax and regulatory systems. It is complex and multi-faceted.

Examples of shadow

economy behaviours include tax and identity fraud, dealing in illegal drugs

and tobacco, and money laundering.

In 2016, it was estimated that the size of the shadow

economy had likely doubled since

2012 from 1.5% of GDP to around 3% of GDP, or approximately $50 billion (p.

7). For that reason, the Government established the Black Economy

Taskforce in 2016 to combat the shadow economy. The Taskforce released the Black

Economy Taskforce Final Report in 2017. In the 2018–19 Budget, the Coalition

Government responded to the report with a

whole-of-government program for tackling the shadow economy and the

implementation of the Taskforce’s recommendations is ongoing.

Closing the Tax Gap: Domestic and

International combined

Tax Avoidance Taskforce

The Tax Avoidance

Taskforce is expected to reduce the tax gap by $2.8 billion over the

forward estimates. It will achieve this by ensuring large businesses and

wealthy individuals pay the right amount of tax in Australia. It focuses on

targeting promoters of tax avoidance who support or promote illegal behaviours

and arrangements. This Taskforce works with partner agencies and other

jurisdictions to protect the integrity of the tax system.

Established in

2016, the program has helped

collect a total of $12.7 billion from 1 July 2016 to 30 June 2021. Recent

audit cases in the public domain involve companies such as Apple, BHP, Chevron,

Facebook, and Google. In some cases, tax revenues from these entities in Australia

have increased up to 5 times. The taskforce ‘will

pursue new priority areas of observed business tax risks, complementing the

ongoing focus on multinational enterprises and large public and private

businesses’. (p. 12)

Conclusion

Tax

gap estimates measure the performance of the tax system in the past. An

efficient tax system should minimise the tax gap. The current Budget measures

addressing the gap are important. However, as the Budget

strategy and outlook: budget paper no. 1 October 2022–23 (Chart 3.2)

projects the cash deficit to be around 2% of GDP from now to 2032–33, addressing

the tax gap alone is insufficient, and the Australian Government is likely to

need to utilise more ‘tools’ to fix the deficit problem.

On Budget day, the Treasurer

confirmed (p. 15) that ‘tax needs to be part of the [national conversation

about Budget repair] going forward’. He

further explained (p. 15) that:

what we've done in this Budget is we've built a foundation of

a more sustainable Budget, but there's more work to do and that will involve

ongoing spending restraint, it will involve trimming spending where we can,

targeted investments and also tax reform.

Tax reform is an economic and social process that requires

the Parliament to reach a political consensus on the trade-offs between the

criteria for a good tax system (economic efficiency, equity, simplicity,

flexibility, sustainability and policy consistency). This Budget seems to be a

catalyst starting that conversation.

Appendix A Progress

summary of Australia’s implementation of the BEPS 15 Actions

| BEPS Action |

Status |

| Action 1: Address the tax challenges of the digital

economy |

In progress |

| Action 2: Neutralise the effects of hybrid mismatch

arrangements |

Implemented |

| Action 3: Strengthen controlled foreign company

(CFC) rules |

Implemented |

| Action 4: Limit base erosion involving interest

deductions and other financial payments |

In progress |

| Action 5: Counter harmful tax practices more

effectively, taking into account transparency and substance |

Implemented |

| Action 6: Prevent treaty abuse |

Implemented |

| Action 7: Prevent the artificial avoidance of the

permanent establishment status |

In progress |

| Actions 8–10: Assure that transfer pricing outcomes

are in line with value creation |

Implemented |

| Action 11: Establish methodologies to collect and

analyse data on BEPS and the actions to address it |

In progress |

| Action 12: Require taxpayers to disclose their

aggressive tax planning arrangements |

In progress |

| Action 13: Re-examine transfer pricing

documentation |

Implemented |

| Action 14: Make dispute resolution mechanisms more

effective |

Implemented |

| Action 15: Develop a multilateral instrument to

modify bilateral tax treaties |

Implemented |

Note: The information in this table is correct at the

publication date. The information may change as Australia progresses with the

implementation of the remaining outstanding BEPS actions.

Source: Australian Taxation Office, Base

erosion and profit shifting.

All online articles accessed October 2022

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth Coat of Arms, and to the extent that copyright subsists in a third party, this publication, its logo and front page design are licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia licence.

In essence, you are free to copy and communicate this work in its current form for all non-commercial purposes, as long as you attribute the work to the author and abide by the other licence terms. The work cannot be adapted or modified in any way. Content from this publication should be attributed in the following way: Author(s), Title of publication, Series Name and No, Publisher, Date.

To the extent that copyright subsists in third party quotes it remains with the original owner and permission may be required to reuse the material.

Inquiries regarding the licence and any use of the publication are welcome to webmanager@aph.gov.au.

This work has been prepared to support the work of the Australian Parliament using information available at the time of production. The views expressed do not reflect an official position of the Parliamentary Library, nor do they constitute professional legal opinion.

Any concerns or complaints should be directed to the Parliamentary Librarian. Parliamentary Library staff are available to discuss the contents of publications with Senators and Members and their staff. To access this service, clients may contact the author or the Library‘s Central Enquiry Point for referral.