Budget Review 2022–23 Index

Dr Hazel Ferguson

The Government continues its focus

on apprentice support in the 2022–23 Budget, with $1.3 billion over 5 years

from 2021–22 provided to extend wage

subsidies, provide additional in-training

support, and introduce a new Australian

Apprenticeships Incentive System (AAIS) in place

of current arrangements from 1 July 2022 (Budget measures:

budget paper no. 2: 2022–23, pp. 76–77).

Apprentice

wage subsidies

A central element of the

Government’s response to the COVID-19 pandemic in skills training was the

introduction of two apprentice wage subsidies:

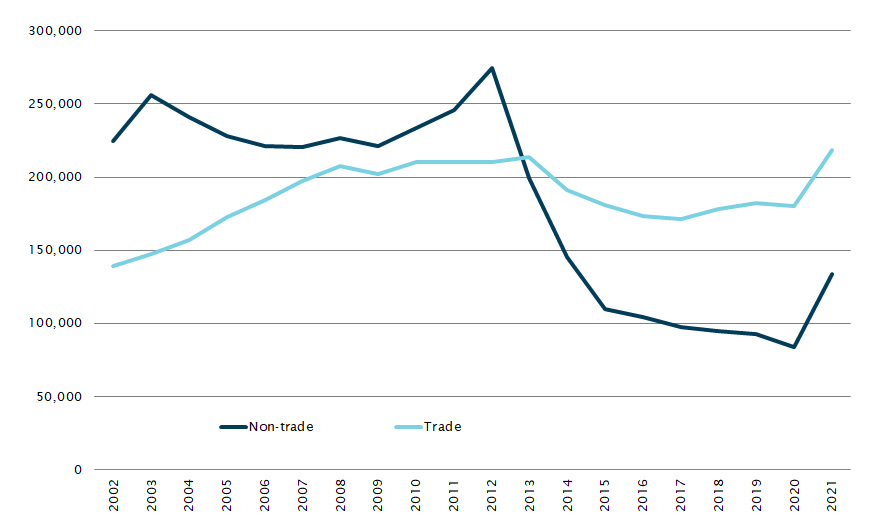

Trends in apprenticeship numbers (Figure 1), suggest the

wage subsidies have contributed to a substantial turnaround in the number of

apprentices in training. The latest

data from the National Centre for Vocational Education Research, for September 2021, shows 352,020 apprentices and trainees

in-training—an increase of 33.2% from September 2020. However, this data also

shows early signs that increased uptake may be resulting in increasing

cancellations and withdrawals, with these reaching 25,205 in September 2021, up

by 51.9% compared with 2020.

Figure 1 Apprentices in training, trade and non-trade

occupations, September quarter, 2002–2021

Source: National

Centre for Vocational Education Research, VOCSTATS, extracted 30 March 2022.

New BAC enrolments were scheduled

to cease at the end of March 2022. On

27 March, the Government announced that the

program would be extended to the end of the 2021–22 financial year. Budget paper no.

2 (p. 77) provides $365.3 million for

this purpose, and for support beyond the year of commencement through Completing

Apprenticeship Commencements (CAC).

According

to the Department

of Education, Skills and Employment (DESE), if an apprentice is engaged before 30 June 2022,

the employer will be able to access:

-

a 50% wage subsidy, up to $7,000 per quarter, for 12 months through BAC

-

a 10% wage subsidy, up to a maximum of $1,500 per quarter, for the second year

of the apprenticeship, through CAC

-

a 5%

wage subsidy, up to $750 per quarter, for the third year of the apprenticeship,

also through CAC.

A new

Australian Apprenticeships Incentive System

Wage subsidies were introduced to a system of existing

apprenticeship incentives provided through the Australian

Apprenticeships Incentives Program (AAIP), which has been in

place since 2006. The AAIP provides a range of incentive payments to

support training in Priority Occupations (Aged Care, Child Care, Disability

Care Workers and Enrolled Nurses) and occupations on the National

Skills Needs List. A variety of different payments are provided through the

AAIP, including employer payments for commencement, retention, recommencement,

and completion.

In 2019, the Strengthening skills

expert review of Australia’s vocational education and training system

(the Joyce Review, p. 78) observed that the AAIP has been ‘subject to multiple

changes to the eligibility criteria and the incentives amounts, particularly

for existing workers in 2012 and 2013’ (the marked effect of these changes is

evident in Figure 1, especially in relation to non-trade occupations). The

Joyce Review found that the complexity of the AAIP can act as a barrier for

apprentices and employers and recommended revamping and simplifying

apprenticeship incentives to increase their attractiveness to employers and

trainees. The

Government’s response, delivered in the 2019–20 Budget, provided funding

for this purpose.

However, with the onset of the COVID-19

pandemic, the July 2020 Economic

and fiscal update (July Update, pp. 119–120)

announced that the introduction of new incentive arrangements would be delayed,

and planned changes have still not been implemented.

This Budget announces that from 1

July 2022, a new Australian

Apprenticeships Incentive System (AAIS) will commence in place of the wage

subsidies and the AAIP, replacing changes to apprentice incentives previously

announced in response to the Joyce Review. In place of the National Skills

Needs List and Priority Occupations, the AAIP will be based on a new Australian

Apprenticeships Priority List (the Priority List) which includes Technician

and Trade Workers and Community and Personal Service Workers occupations assessed

by the National Skills Commission

as being in national skills shortage.

According to the Australian

Government’s Australian Apprenticeships website, introduction of the AAIS

will take place in two phases:

- phase

1, which will run from 1 July 2022 to 30 June 2024, will provide support via:

- hiring

incentives of $3,500 for employers of apprentices in non-priority occupations

- wage

subsidies of 10% for first and second year apprentices (up to $1,500 per

quarter) and 5% for third year apprentices (up to $750 per quarter) for employers

of apprentices in occupations on the Priority List (with additional subsidies

available for employers in rural and remote areas)

- a direct

payment of up to $5,000 over 2 years for apprentices in occupations on the

Priority List.

- phase

2, which will run from 1 July 2024, will provide support for occupations on the

Priority List only, in the form of:

- a

hiring incentive of up to $4,000 for employers

- a

new Australian Apprentices Training Support Payment of up to $3,000 for

apprentices.

Payments are

administered through Australian

Apprenticeship Support Network providers.

In order to align

eligibility for the Trade

Support Loans (to be renamed Australian Apprenticeship Support Loans) with

the new arrangements, the Trade Support Loans

Act 2014 will need to be amended to ensure all apprentices in

occupations on the Priority List are eligible (Australian

Apprenticeships Incentive Reform fact sheet and Education,

skills and employment portfolio budget statements (PBS) 2022–23, p. 13).

Additional support for apprentices

A small amount of funding is also committed

in the Budget to provide additional support for apprentices during their

training:

- As part of the major package of changes to incentives, $2.8 million is

provided for an additional 2,500 in-training support places in 2022–23 for 15

to 20-year-olds.

- As

part of the Women’s

budget statement (p. 44) $38.6 million over 4 years from 2022–23 is provided

for additional support for women who commence an apprenticeship in a trade

occupation on the Priority List. Gateway support services and in-training

support places will be guaranteed for these women in non-traditional trades.

Stakeholder response and concluding

comments

This Budget grapples with the dual challenges of maintaining

recent momentum in apprenticeship uptake, while providing sufficient support to

ensure those who enter the system can complete their training.

The National

Apprentice Employment Network has welcomed the extension of the BAC wage

subsidy, and supplementation of this incentive with the CAC program in the

second and third year of an eligible apprenticeship, stating this ‘will help

address possible drop-outs after the first 12 months’.

However, the Australian

Chamber of Commerce and Industry has pointed to possible challenges

transitioning to the AAIS, as the less-generous wage subsidies make taking on

an apprentice less cost effective for employers than in recent years.

All online articles accessed April 2022

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth Coat of Arms, and to the extent that copyright subsists in a third party, this publication, its logo and front page design are licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia licence.

In essence, you are free to copy and communicate this work in its current form for all non-commercial purposes, as long as you attribute the work to the author and abide by the other licence terms. The work cannot be adapted or modified in any way. Content from this publication should be attributed in the following way: Author(s), Title of publication, Series Name and No, Publisher, Date.

To the extent that copyright subsists in third party quotes it remains with the original owner and permission may be required to reuse the material.

Inquiries regarding the licence and any use of the publication are welcome to webmanager@aph.gov.au.

This work has been prepared to support the work of the Australian Parliament using information available at the time of production. The views expressed do not reflect an official position of the Parliamentary Library, nor do they constitute professional legal opinion.

Any concerns or complaints should be directed to the Parliamentary Librarian. Parliamentary Library staff are available to discuss the contents of publications with Senators and Members and their staff. To access this service, clients may contact the author or the Library‘s Central Enquiry Point for referral.