Budget Review 2021–22 Index

Rob Dossor

|

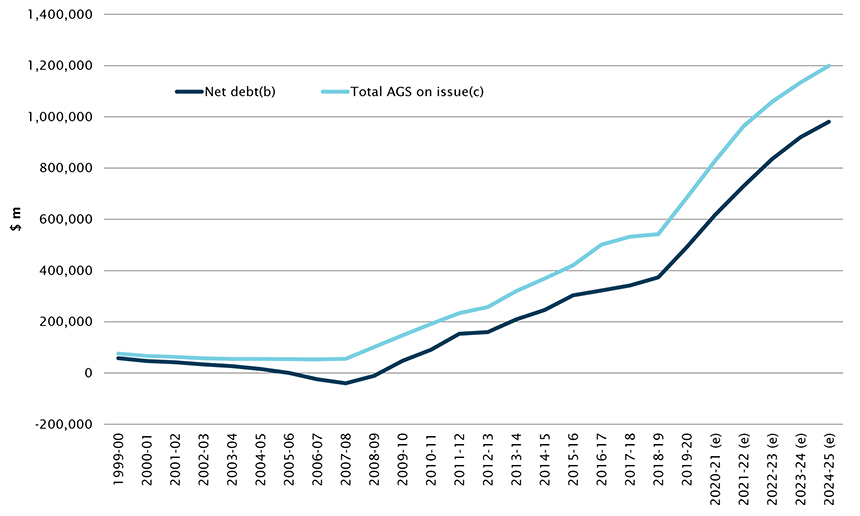

Gross

debt is the

face value of Australian

Government Securities (AGS) (Treasury bonds and notes) on issue.

More often reported, net

debt is the sum of all financial liabilities (gross

debt) of a government less its respective financial assets (see OECD Glossary of Statistical terms).

Gross

debt indicates

the magnitude of debt owed, but it does not show whether a government can repay

that debt and provides limited detail about the overall financial health of a

government. This is where net

debt is significant. If a government has a gross debt of 50 per

cent of GDP, but has large amounts of cash and/or assets (low net debt), then

it is in a much better position to handle this level of debt.

|

The Budget projects that the Commonwealth government’s gross

debt will be around $963 billion at 30 June 2022. This is around 45.1% of

GDP. It is projected to increase to $1,199 billion—around 50% of GDP—by 30 June

2025 (Budget

Strategy and Outlook: Budget Paper No.1: 2021–2022, Table 11.5,

p. 366–7).

Net debt is expected to be $729 billion—or 34.2% of GDP—at

30 June 2022 and peak at $981 billion or 40.9% of GDP in 2024–25 (Table 11.4, p.

364–5). Net debt is then projected to fall over the medium term to 37% of GDP

at 30 June 2032 (p. 203).

Australia’s forecast debt levels are slightly lower than

what was projected in the 2020–21 Budget, which forecast gross debt to reach

$1,138 billion by 30 June 2024, compared to $1,134 billion for the same period,

in this Budget.

These gross and net debt levels are shown, to 2024–25, in

Chart 1 below.

Chart 1: gross

and net debt levels

Source: Budget

strategy and outlook: budget paper no. 1: 2021–22, Statement 11, p. 365 and 367.

International comparison

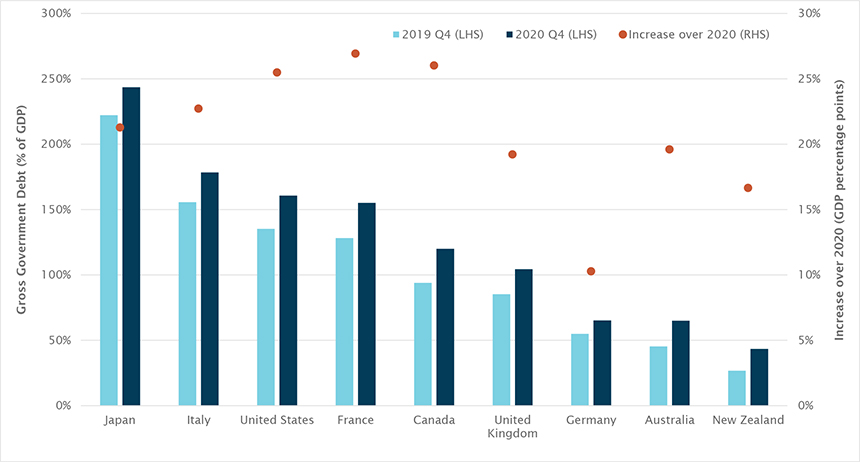

It is not surprising that debt levels have increased so

significantly during the COVID-19 pandemic which has led to a considerable

increase in government spending.

Australia’s debt level, however, remains low compared to

most developed countries. As shown in Chart 2, Australia’s pre-pandemic debt

was lower than most comparable countries and this remains true post-pandemic. In

2020 Gross Government Debt (for all levels of Government) increased across all

major economies depicted in Chart 2, with Australia’s increase of just

under 20%, similar to the UK and New Zealand, and below the US, Canada, and

France.

Chart 2: gross

Government debt, international comparison

Source: Oxford Economics

Debt sustainability

The amount of Commonwealth debt is causing some commentators

to be concerned that the Commonwealth may have to devote an increasing share of

revenue to meet interest expenses, and that this may lead to a need to increase

taxes, cut spending, sell assets and/or further increase debt. Tim

Colebatch, for instance, argues that this will leave the job of servicing

and repaying the debt to future generations.

An alternative view is expressed in the Budget which notes

that stronger economic growth expected over the coming years, coupled with low

costs of servicing debt, will enable the Government to maintain a steady and

declining ratio of debt to GDP over time, while running a modest deficit.

This view finds support from other observers who argue that,

although Australia’s debt levels have risen dramatically in the last year, commensurate

with the international experience, debt levels are not a cause for concern,

largely due to low interest rates.

Guy Debelle, Deputy Governor

of the Reserve Bank of Australia (RBA), for example, said in a speech

in November 2020:

in Australia, public debt is

very manageable. Public sector debt remains low as a share of GDP for the

Australian Government … Borrowing costs are likely to remain very low for quite

some time, and almost certainly until the economy is considerably stronger.

This means that the debt dynamics for the Australian Government and the states

and territories are absolutely sustainable.

The International

Monetary Fund (IMF) outlines that a number of factors determine how much

debt a country can carry before the burden becomes excessive, including the

quality of institutions and debt management capacity, policies, and

macroeconomic fundamentals. Generally speaking, Australia’s institutions, policies,

and macroeconomic fundamentals are considered to be robust.

An earlier (2018) IMF

working paper outlines that the critical factor determining a country’s

maximum sustainable debt level is the difference between its future nominal

interest rate and its growth in economic activity. When the growth in cost of

servicing the debt (i.e. the interest) is lower than the rate of economic

growth, then the debt will be sustainable, as the economy is growing faster

than the debt servicing costs. Australian economist Professor John Quiggin makes

a similar point, provided that inflation stays moderate and there is

productivity growth.

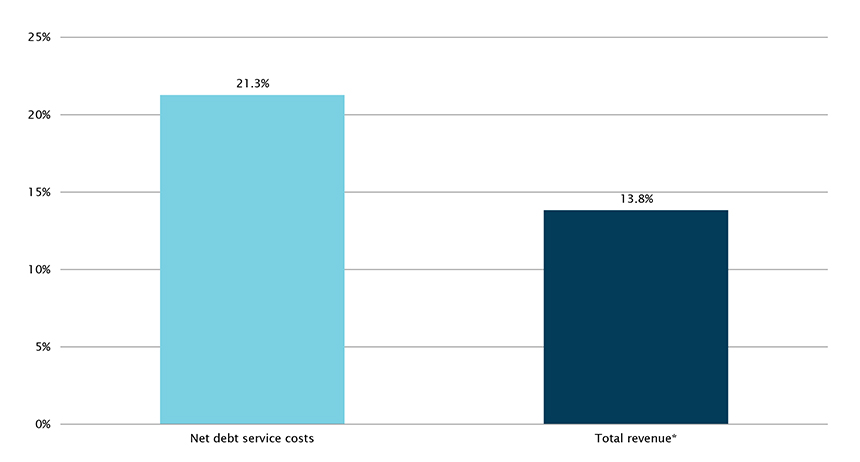

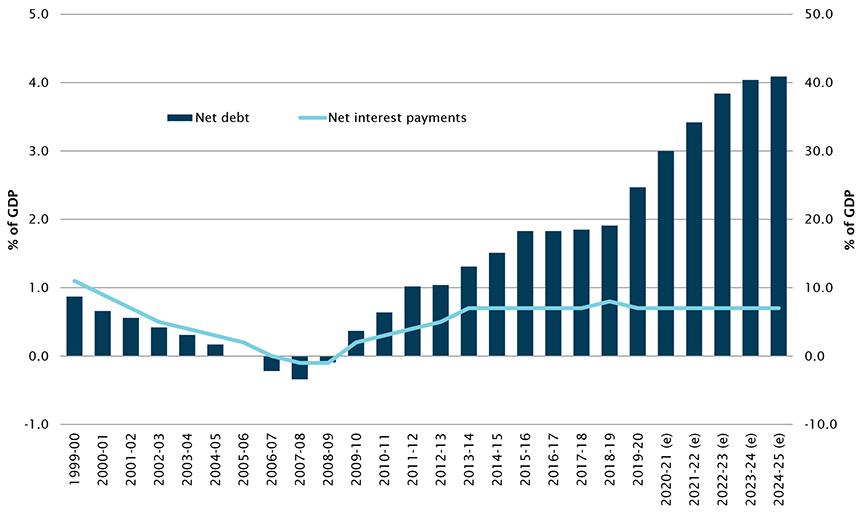

Chart 3 below, shows that the cost of servicing Australia’s

forecast debt is predicted to increase faster than forecast Australian

Government revenue (not including GST). While this may cause some concern, it

should be noted that the cost to service this debt remains consistent at 0.7%

of GDP over the medium-term forecasts, as shown by Chart 4. This occurs because

real GDP is forecast to increase by 4.25% in 2021–22, and then moderate to between

2.25% and 2.5% over the forward estimate periods, and the expectation is that

interest rates will remain low for some years.

The Budget’s growth forecasts are consistent with those of

the RBA and Oxford Economics. The RBA in its May

2021 Economic Outlook forecasts GDP growth of 4% in 2021–22 and 3% in

2022–23. Oxford Economics in its May 2021 Economic Outlook Australia forecasts GDP growth of 3.6% in 2021–22 and 2.4% in 2022–23. Both the RBA and Oxford

Economics forecast that CPI inflation will remain subdued in the medium term.

Chart 3: net

growth over forward estimates, cost to service Australian Government debt and

Australian Government revenue

*Includes total receipts excluding GST and non-taxation

receipts

Source: Budget

strategy and outlook: budget paper no. 1: 2021–22, Statement 11, p. 365 and Statement 5, p. 129.=

Chart 4:

Australian Government Securities Interest cost and Government revenue

Source: Budget

strategy and outlook: budget paper no. 1: 2021–22, Statement 11, p. 365.

The Parliamentary Budget Office (PBO), in its recent Fiscal

Sustainability Report, assessed the way that different

levels of interest rates, economic growth and the Government’s budget balance would

affect the sustainability of the Government’s debt position. Of the 27

scenarios tested, the PBO found:

only the highly unlikely scenario of a generation of low

economic growth combined with high interest rates and large budget deficits

results in debt increasing as a share of GDP, after 2050.

The scenarios also show that a sustainable fiscal position

can be maintained even if the budget remains in a modest deficit position over

the long term, although reaching that position will require governments to

continue to increase revenue and/or contain spending to return the budget

balance to the average levels recorded over time. (p. iii)

Finally, it should be noted that an economy does not need to

pay off debt to bring down the relative level of debt. As an economy grows, provided

the debt is stabilised, the debt will shrink relative to the size of the

economy

Risks

Recently, an article in the Australian

Financial Review warned that Australia could lose its AAA credit rating

as soon as September 2021, due to the Budget forecast of persistent budget deficits

over the next decade. A downgrading to AA+ could result in higher interest rates

on new debt.

Whether Australia’s credit rating changes or not, an

increase in interest rates will increase the cost of issuing new debt. If

interest rates were to rise significantly, it would put upwards pressure on the

sustainability of debt, in the same manner as a downgrading of Australia’s

credit rating.

Only if Australia’s debt servicing costs become

unsustainable would it be a cause for concern, as the PBO noted.

Australia’s relatively low pre-pandemic debt position

allowed debt to increase dramatically, but within the sustainable envelope. This

debt level is not forecast to begin reducing until the 2025–26 financial year,

which raises the question–in the event of another economic shock, will

Australia be able to further leverage the balance sheet and stimulate the

economy?

The IMF

notes that advanced economies with ample fiscal space (such as Australia)

may not need to worry about the ability to respond to future economic shocks, but

those with very high debt may need start thinking about the implications. As

the comparison above shows, Australia has relatively low debt and so will

likely retain fiscal capacity to respond to future economic shocks.