Michael Klapdor, Alex Grove and Lauren Cook

Key figures

Social security and welfare expenditure in 2019–20 is

estimated to be $180.1 billion, representing 36.0 per cent of the

Australian Government’s total expenditure.

This administrative category of expenditure consists of a

broad range of services and payments to individuals and families. It includes:

- most income support payments such as pensions and allowances (for

example, the Age Pension and Newstart Allowance)

- family payments such as Family Tax Benefit and the Child Care

Subsidy

-

Parental Leave Pay

-

funding for aged care services

- the National Disability Insurance Scheme (NDIS) and

- payments and services for veterans and their dependants.

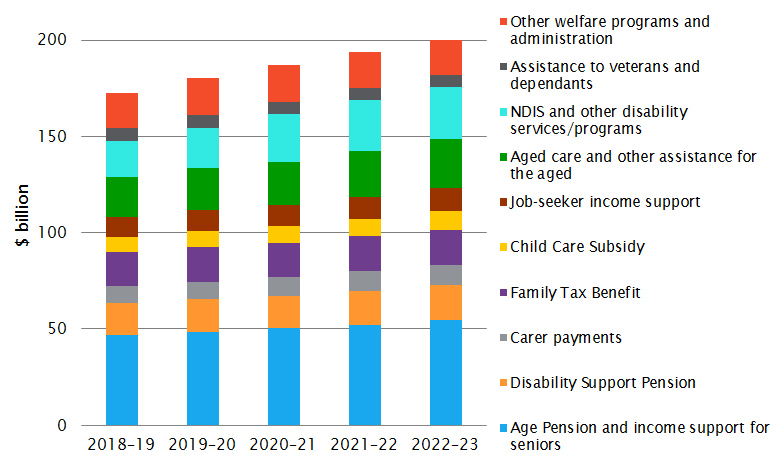

While total expenditure on social security and welfare is

expected to increase from around $172.7 billion in 2018–19 to $200.2 billion in

2022–23, there are different trends within sub-categories of expenditure.

Figure 1 provides a breakdown of the social security and

welfare category showing key sub-categories including major payments and

services.

Figure 1: estimated Australian Government expenses on

social security and welfare

Source: Australian Government, Budget strategy and outlook: budget

paper no. 1: 2019–20, pp. 5-22–5-26.

Key drivers of expenditure

increases

Assistance to people with disability

The biggest driver of growth in social security and welfare

continues to be the NDIS. Total funding for the scheme is expected to grow from

$13.0 billion in 2018–19 to $24.8 billion in 2022–23. Just over half of the

total $88.1 billion in NDIS expenses from 2019–20 to 2022–23 is contributed by

the Australian Government ($45.7 billion) with states and territories

contributing the remaining funding. The Budget

notes that some of the Commonwealth expenditure on the NDIS will be counted

twice as National Disability specific purpose payments to the states and

territories cease—part of these payments are repaid to the Commonwealth and

then counted again as expenditure on the NDIS (p. 5-24).

The

full scheme was meant to be up and running nationally in 2019–20,

supporting 460,000

participants aged under 65. The Government notes that there has been a ‘slower

than expected transition of participants into the NDIS’ and as at December 2018

there were 244,653

people accessing the NDIS.[1] This has

reduced projected expenditure on the scheme since the Mid-Year Economic

and Fiscal Outlook 2018–19 by $1.6 billion over the forward

estimates (p. 3-22). The reduction in projected expenditure was expected to be

even higher until a

decision was made on 30 March 2019 to increase prices paid to service

providers.

The Budget

provides information on growth in expenses accounting for inflation—that is,

growth in real terms (pp. 5-22–5-24). The tables below provide information on

nominal expenditure.

Overall expenditure on assistance to people with disability is

expected to grow by 4.5 per cent in real terms from 2018–19 to 2019–20 and by

10.0 per cent in real terms from 2019–20 to 2022–23. Income support for people

with disability (primarily the Disability Support Pension (DSP)) is expected to

decrease by 2.3 per cent in real terms from 2019–20 to 2022–23. This decrease

has been primarily driven by a range of policy changes relating to eligibility

and assessment processes, implemented by both Labor and Coalition governments.

The government

administrative data shows that the number of DSP recipients has declined

from 832,024 people in December 2013 to 750,045 people in December 2018.

Table 1: expenses on assistance to

people with disabilities, $ million

| Component |

2018–19

(est.) |

2019–20

(est.) |

2020–21

(est.) |

2021–22

(proj.) |

2022–23

(proj.) |

| Income support for people with disability |

16

699 |

17

057 |

17

044 |

17

618 |

17

889 |

| National Disability Insurance

Scheme (NDIS)(a) |

12

989 |

17

524 |

22

253 |

23

523 |

24

806 |

| Income support for carers |

8

770 |

9

207 |

9

493 |

10

038 |

10

552 |

| Assistance to the states for disability

services |

958 |

173 |

- |

- |

- |

| Disability and carers |

1

012 |

1

084 |

1

085 |

1

095 |

1

112 |

| NDIS Transition Programme |

500 |

219 |

38 |

32 |

37 |

| National Partnership Payments –Assistance

to People with Disabilities |

3

151 |

1

742 |

1

295 |

1

336 |

1

104 |

| Total |

44

079 |

47

005 |

51

209 |

53

641 |

55

499 |

(a) Includes both Commonwealth and state contributions

to the NDIS through the National Disability Insurance Agency, a Commonwealth

agency.

Notes: Totals may not add due to rounding.

Source: Australian Government,

Budget strategy and outlook: budget paper no. 1:

2019–20, p. 5-24.

Assistance to the aged

The biggest component of social security and welfare

expenditure, the Age Pension and other income support for seniors will increase

from $46.7 billion in 2018–19 to $54.8 billion in 2022–23. Growth in Age

Pension expenditure is being partly restrained by the commencement in 2017 of a

Rudd

Government measure to gradually increase the pension age to 67 (pp. 17–22).

Expenditure on aged care is expected to increase by 11.2 per

cent in real terms from 2019–20 to 2022–23. Nominal expenditure will increase

from $20.0 billion in 2019–20 to $23.9 billion in 2022–23. This growth in

expenditure is primarily driven by demographic changes (an ageing population)

and the impact of the 2018–19 budget measure More

Choices for a Longer Life—healthy ageing and high quality care.

Table 2: expenses on assistance to

the aged, $ million

| Component |

2018–19

(est.) |

2019–20

(est.) |

2020–21

(est.) |

2021–22

(proj.) |

2022–23

(proj.) |

| Income Support for Seniors |

46

741 |

48

301 |

50

265 |

52

285 |

54

766 |

| Aged Care Services |

18

764 |

20

027 |

20

902 |

22

374 |

23

903 |

| Veterans’ Community Care and

Support |

1

202 |

1

130 |

1

136 |

1

109 |

1

025 |

| Access and information |

234 |

245 |

221 |

225 |

228 |

| Mature Age Income Support |

171 |

131 |

54 |

10 |

- |

| Aged Care Quality |

242 |

221 |

215 |

207 |

210 |

| Allowances concessions and

services for seniors |

92 |

83 |

75 |

68 |

61 |

| National Partnership Payments –

Assistance to the Aged |

3 |

13 |

15 |

15 |

21 |

| Total |

67 449 |

70 151 |

72 884 |

76 293 |

80 215 |

Notes: Totals may not add due to rounding; ‘‑’ means

zero.

Source: Australian Government,

Budget strategy and outlook: budget paper no. 1:

2019–20, p. 5-23.

Expenditure decreases

A number of areas are expected to see a decrease in expenses

(pp. 5-23–5-26):

- a decrease in the number of veterans and dependants accessing

residential aged care will see a 15.4 per cent decrease in real

expenditure on veterans’ community care and support from 2019–20 to 2022–23

- a decline in the population of veterans will see expenditure on

assistance to veterans and dependants decrease by 12.3 per cent in real terms

from 2019–20 to 2022–23 despite new spending on improving Department of

Veterans’ Affairs’ services through the Veteran Centric Reform

- expenditure on Family Tax Benefit is expected to decrease by 5.1

per cent in real terms from 2019–20 to 2022–23, reflecting the impact of changes

to the income tests, freezes on indexation of payment rates and freezes on

indexation of income test thresholds

- expenditure on assistance for Indigenous Australians not

elsewhere classified will decrease by 6.6 per cent in real terms from

2019–20 to 2022–23. The Budget

attributes this decline to a significant expenditure from the Aboriginals

Benefit Account in 2018–19 but decreased expenditure over the forward

estimates, and the 2019–20 budget measure, Single

National Mechanism for Commonwealth Legal Assistance, which will shift

where funding for Aboriginal and Torres Strait Islander legal services is

reported in the budget papers to the Courts and Legal Services sub-function of

the Public Order and Safety function (pp. 5-25–5.26).

Significant policy announcements

Social security

A change

to the way income is assessed for social security payments is expected to

provide $2.1 billion in savings over the forward estimates, the largest

single savings measure in the 2019–20 Budget (p. 33). Currently, income

support recipients with employment income need to calculate and report the

income they have earned in a payment fortnight; that is, the amount they should

be paid for the hours of work they have undertaken in that fortnight, not the

income they have actually receive in that fortnight. Under the change, income

support recipients will report the income they receive from their employer in a

relevant fortnight and the Department of Human Services will match the reported

income with the amount their employer has reported to the Australian Tax Office

through the single-touch payroll system to detect any discrepancy that would

affect their payment rate. The measure is expected to result in savings through

more accurate income reporting, and therefore fewer overpayments. As

overpayments are considered debts to the Commonwealth, the savings would not be

derived from reducing currently identified overpayments—rather, the measure

appears to be deriving savings from reducing overpayments that would not

previously have been identified.

The Budget includes a one-off Energy Assistance

Payment of $75 for singles or $125 for couples to be provided to pensioners

and certain veterans’ affairs payment recipients. In the initial announcement,

recipients of allowance payments such as Newstart Allowance and Youth Allowance

were not eligible for the payment. However, in tabling

the Bill for the payment, the Government reversed this position and

expanded eligibility to all allowance recipients. The measure announced in the Budget

was expected to

cost $284.4 million over two years (p. 159) while the expanded measure is

expected to cost $365.0 million over the forward estimates.

Existing trials of the

cashless debit card will be extended for one year, and the cashless debit card

will replace the BasicsCard system used for income management in other

locations around Australia, including the entire Northern Territory.[2]

The measures will

cost $128.8 million over the forward estimates (p. 157).

An additional $84.3

million will be allocated to the Integrated Carer Support Service (p. 162).

Under the measure, carers

will be able to access up to 5,000 financial packages worth up to $3,000

through a network of Regional Delivery Partners. Up to 25 per cent of all

packages will be reserved for young carers to support their continuing

participation in education or employment. Services available through the

packages can include transport and respite.

Aged care

The Budget includes $724.8 million over five years from

2018–19 for increased aged care funding and quality regulation, much of which

was announced

in February 2019. Some of the funding has already been included in the

forward estimates.

Residential aged care providers will receive a $320.0

million short-term increase in funding in the form of a 9.5

per cent temporary increase in the basic subsidy for residents from 20

March until 30 June 2019. The financial performance of residential aged care

providers has

been declining since 2016, when changes

to the basic subsidy were made. The Budget also includes $4.6 million to trial

an alternative residential aged care funding tool. If adopted more broadly,

this tool would change

the way that funding for residential aged care (including the basic subsidy) is

calculated.

The Budget provides 10,000

additional home care packages across all levels, at a cost of $282.4

million over five years from 2018–19. This is in addition to the 10,000

high-level packages announced in the Mid-Year Fiscal and Economic Outlook 2018–19. Home care packages are coordinated packages of care which assist older people to stay at home

rather than entering residential aged care. While providing a

significant increase in the number of packages available, this measure will not

be enough to clear the waiting list of around 128,500 people who are either

not receiving a package at all, or not receiving a package at their approved

level of care.

The Budget includes a number of measures to increase the

regulation of quality in both home and residential care. The largest of these

in dollar terms is $38.4 million over five years from 2018–19 to establish

a real-time information sharing system within the Aged Care Quality and

Safety Commission. The purpose of the system is to help the Commission quickly

identify and respond to poorly performing providers, while continuing regular

monitoring of all providers.

The Commonwealth

Home Support Programme (CHSP) will be extended

for two years to 30 June 2022 at a cost of $5.9 billion, which has already

been included in the forward estimates. The CHSP is the entry-level aged care

program and provides services such as social support, transport,

help with domestic chores, personal care, home maintenance, home modification,

nursing care, meals and allied health services. The CHSP was last extended in the 2017–18 Budget, and

current CHSP grant agreements with providers expire on 30 June 2020.

Disability

In the Budget, the

Government announced it would no longer proceed with a 2016–17 budget measure

to establish the National Disability Insurance Scheme Savings Fund (p. 8). The

fund was intended to be a special account that would capture savings from other

measures—such as the recently reversed 2016–17

budget measure to close access to the Energy Supplement to new income

support recipients—to be redirected to the NDIS. The Government has been unable

to pass

legislation to establish the fund and the budget papers state

that the ‘positive budget position means that future funding for the NDIS has

been secured’ (p. 8).

On 19 February 2019, a motion

passed the House of Representatives, which called on the Government to

establish a Royal

Commission to inquire into violence, abuse and neglect of people with a

disability. In the 2019–20 Budget,

the Government has provided $527.9 million over five years to support the work

of this Royal Commission (p. 54). This includes:

- $379.1 million in funding for the Attorney-General’s Department

to run the Royal Commission, to provide legal assistance to witnesses, and to

represent the Commonwealth in the proceedings (this funding is not considered

as social security and welfare expenditure) and

- $148.8 million over three years to the Department of Social

Services, the National Disability Insurance Agency and the National Disability

Insurance Scheme Quality and Safeguards Commission to provide counselling

services and other support to people with disability in connection with their

participation in the Royal Commission.

Preventing violence against women

and children

The Budget provides $328.0 million over four years from

2018–19 for projects and priorities under the Fourth Action Plan of the National

Plan to Prevent Violence Against Women and their Children 2010–2022.

The Fourth Action Plan, which will cover the period 2019 to 2022, is the final

action plan under the National Plan. This measure follows the Government’s announcement

of 5 March 2019. Detailed information on how the funding will be allocated can

be found in the document Our

Investment in Women’s Safety. Not all of the funding for this measure

is counted as social security and welfare expenditure.

[1].

Media commentary has suggested ‘dramatic delays in both the scheme

transition but also the signing of agreements for “full scheme” with the states

and territories’. R Morton, ‘NDIS

has $5bn in hand but costs are set to soar’, The Australian, 3 April

2019.

[2].

For an explanation of the differences between the two cards, see D

Arthur, ‘BasicsCard

and Cashless Debit Card: what’s the difference’, Parliamentary Library

blog, 23 June 2017.

All online articles accessed April 2019

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth Coat of Arms, and to the extent that copyright subsists in a third party, this publication, its logo and front page design are licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia licence.

In essence, you are free to copy and communicate this work in its current form for all non-commercial purposes, as long as you attribute the work to the author and abide by the other licence terms. The work cannot be adapted or modified in any way. Content from this publication should be attributed in the following way: Author(s), Title of publication, Series Name and No, Publisher, Date.

To the extent that copyright subsists in third party quotes it remains with the original owner and permission may be required to reuse the material.

Inquiries regarding the licence and any use of the publication are welcome to webmanager@aph.gov.au.

This work has been prepared to support the work of the Australian Parliament using information available at the time of production. The views expressed do not reflect an official position of the Parliamentary Library, nor do they constitute professional legal opinion.

Any concerns or complaints should be directed to the Parliamentary Librarian. Parliamentary Library staff are available to discuss the contents of publications with Senators and Members and their staff. To access this service, clients may contact the author or the Library‘s Central Enquiry Point for referral.