Geoff Gilfillan, Statistics

and Mapping

Key Issues

The Australian labour market performed more solidly in the 12 months to June 2016 with relatively strong growth in employment and a modest fall in the unemployment rate

Full‑time employment growth remains subdued and wages have virtually flatlined in real terms over the past three years. After signs of a steady fall in the youth unemployment rate since late 2014 there has been a slight uptick in recent months.

Employment

In the 12 months to June 2016 employment in

Australia grew by 212,000 or 1.8% (in trend terms) to 11.9 million. This growth

rate is just below the annual average for employment growth of 1.9% recorded since

the early 1980s.

However, just over two thirds (68.3%) of employment

growth in the past 12 months was in part‑time employment: around 32% of

employed Australians worked part‑time in June 2016 compared with 26% in

January 2000.

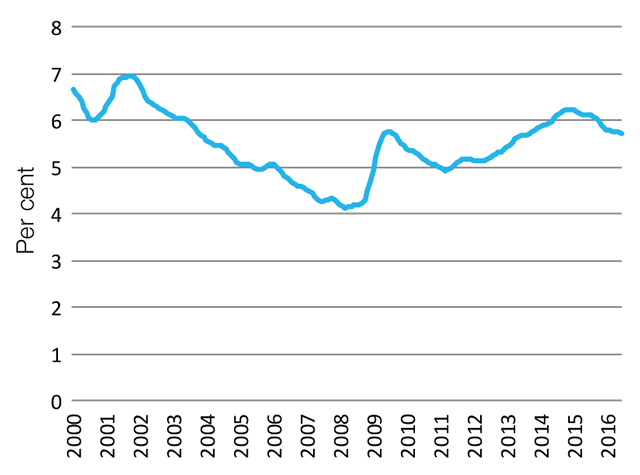

Unemployment

The unemployment rate has fallen by 0.4 percentage

points over the past year to 5.7% in June 2016 (in trend terms). Over this

period, the number of people who are unemployed fell by just over 40,000 to

726,000 (in trend terms).

The most recent low for the unemployment rate in

Australia was 4.1% in April 2008—the lowest unemployment rate recorded since

monthly estimates started being released in February 1978.

Figure 1: Unemployment rate

Source: ABS, Labour force survey,

Australia, cat. no. 6202.0, Table 1, Trend.

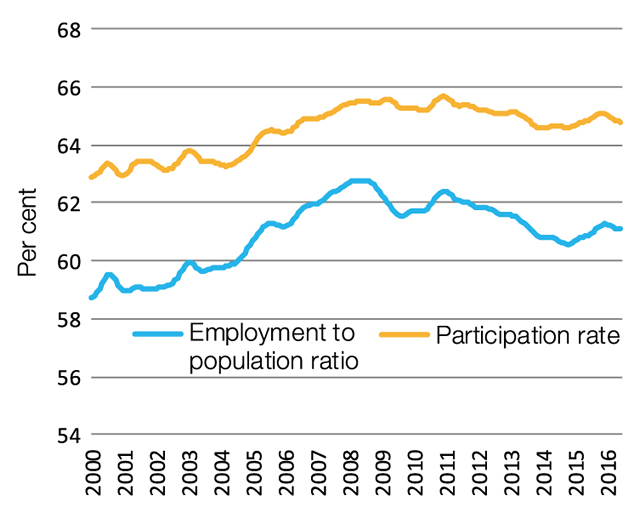

Participation

Other indicators of the health of the labour market

include the proportion of the population aged 15 years and over in the labour

force (participation rate), and the proportion who have a job (employment to

population ratio).

Both measures showed signs of recovery in the 12

months to late 2015 but have since fallen marginally. The labour force

participation rate of 64.8% (in trend terms) in June 2016 is below its most

recent peak of 65.7% in December 2010.

The employment to population ratio (61.1%) in June

2016 is below its most recent peak of 62.8% in July 2008.

Figure 2: Participation and employment rates

Source: ABS, Labour force survey,

Australia, cat. no. 6202.0, Table 1, Trend.

Lower labour force participation is driven by a

combination of discouragement from looking for work for some potential job

seekers, long‑term demographic trends such as the ageing of the

population, and higher rates of engagement in full‑time education by

young people. Conversely, there is evidence of higher participation among older

age groups in recent years—perhaps in response to declining superannuation

balances following the Global Financial Crisis (GFC).

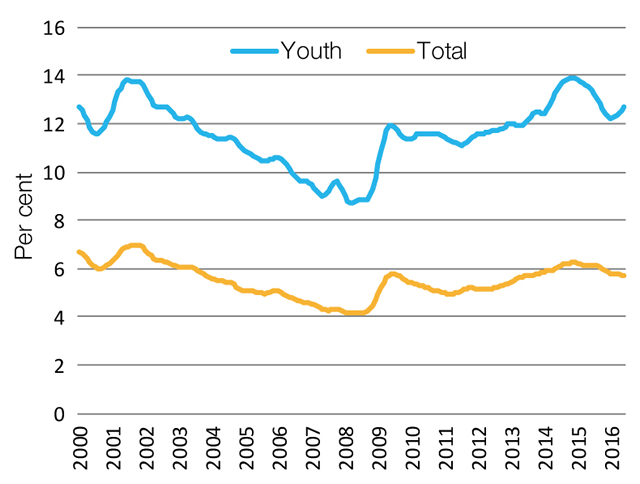

Youth

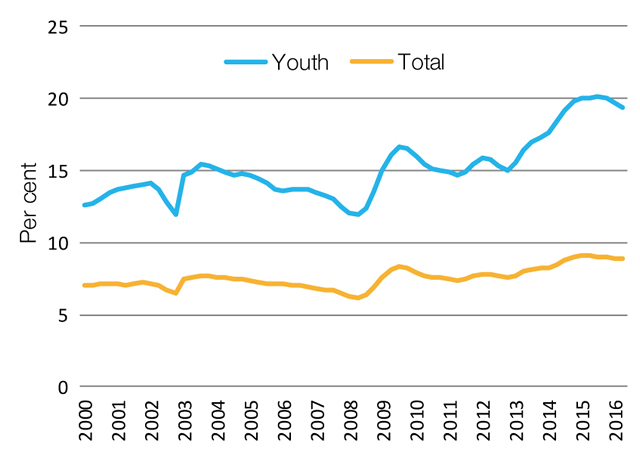

The unemployment rate for young people aged 15 to

24 years stood at 12.7% (in trend terms) in June 2016—well in excess of the total

unemployment rate (people aged 15 years and over) of 5.7%.

While youth unemployment increased steadily from

mid‑2008 to late 2014, a much higher proportion of people in this age

group are now engaged in full‑time study. Over half (54%) of people aged

15 to 24 years were engaged in full‑time study in June 2016 compared with

47% in July 2008.

Figure3: Youth and total unemployment rates

Source: ABS, Labour force survey,

Australia, cat. no. 6202.0, Table 1, Trend.

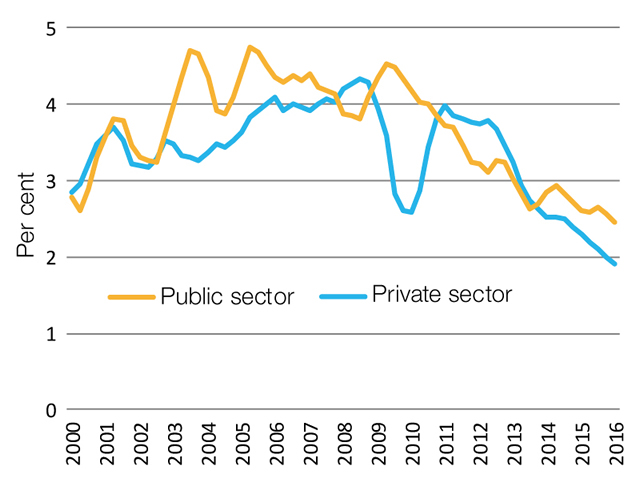

Wages

Wages in both the public and private sectors have grown

at a slower pace in recent years.

Figure 4: Wage Price Index

Source: ABS, Wage price index,

Australia, cat. no. 6345.0, Trend.

Total hourly rates of pay for employees in the

private sector (excluding bonuses) grew by 1.9% in the 12 months to March 2016,

compared with growth of 2.5% for public sector employees.

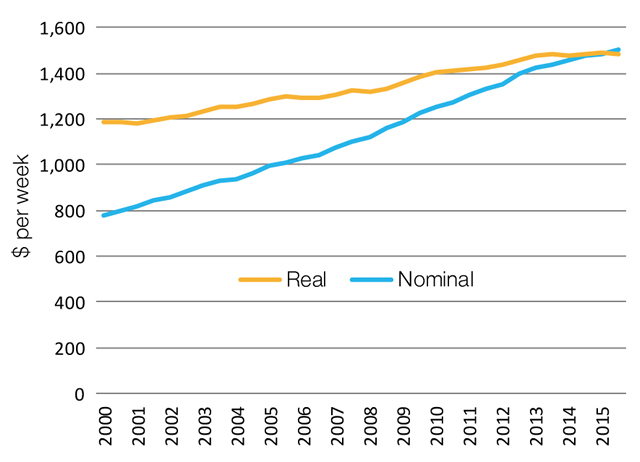

While nominal wages (unadjusted for inflation) have

grown at a slower pace, real wages (adjusted for inflation), as measured by

Average Weekly Ordinary Time Earnings, have virtually flat‑lined since

May 2013.

Figure 5: Nominal and real wages

Source: ABS, Average weekly earnings,

cat. no. 6302.0, Original data. Real wages shown in June 2015 dollars

The Reserve Bank of Australia found wages have been

reacting to a softening in the labour market and increasing spare capacity in

the economy. Declining inflationary expectations also appears to have had some influence.

However, wages growth in the past 12 months remains subdued despite a

strengthening in employment growth and a fall in the unemployment rate.

Underemployment

Underemployment is an indicator of the extent of

underutilised labour in the economy. Underemployed workers include those people

who worked part time and wanted more hours and those who normally worked full

time but were working part time due to being stood down or insufficient work

being available.

Underemployment affects younger workers more than

older workers. Just under 20% of workers aged 15 to 24 years wanted more hours

of work in June 2016 compared with 9% of all workers (aged 15 years plus).

Figure 6: Underemployment ratios

Source: ABS, Labour force survey,

Australia, cat. no. 6202.0, Table 22, Trend.

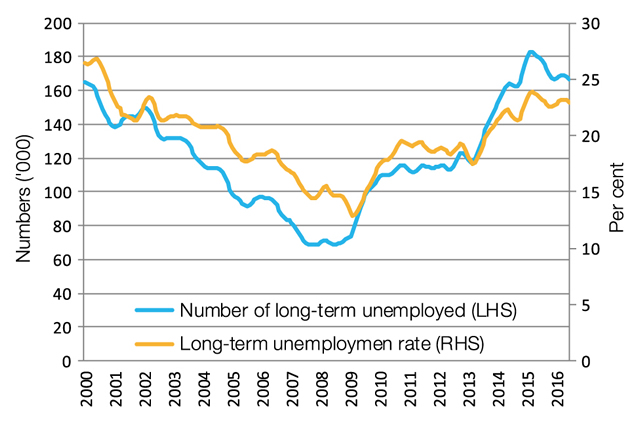

Long‑term unemployment

Long‑term unemployed people are those who have

been unemployed for 12 months or more. Increasing levels and rates of long‑term

unemployment indicates that some unemployed people are taking longer to find

suitable employment.

The level and prevalence of long‑term

unemployment rose sharply from mid‑2008 to late 2010, plateaued until mid‑2013

and has been rising since. The number of people who were long‑term

unemployed has increased from 69,000 in July 2008 to 182,900 in March 2015 (in

trend terms) and has since fallen to 166,600 in June 2016. Around 22.9% of all

unemployed people were long‑term unemployed in June 2016 compared with 12.8%

in February 2009.

Figure 7: Long‑term unemployment

Source: ABS, Labour force survey, cat.

no. 6291.0.55.001, Table 14b, Trend.

Unemployed people in older age groups tend to have

higher rates of long‑term unemployment. In May 2016, 41% of unemployed

people aged 55 to 64 years were long‑term unemployed compared with 18% of

unemployed people aged 15 to 24 years.

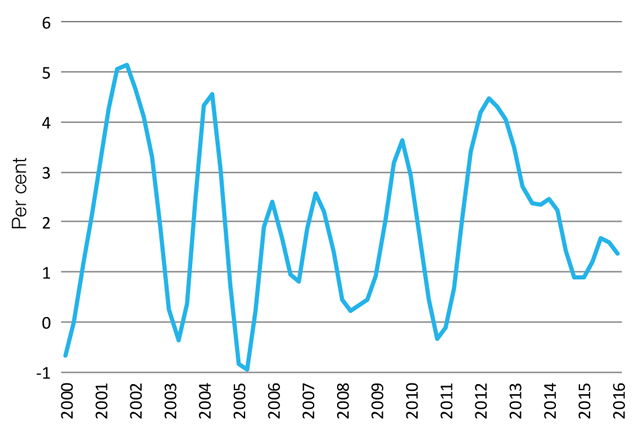

Labour productivity

Labour productivity measures the efficiency of use of labour

and is equivalent to the growth of output above the growth in labour inputs.

The annual rate of growth of labour productivity (as

measured by gross value added per hour worked in the 12-industry market sector)

has been slowing in Australia since mid‑2012. Labour productivity grew by

1.4% per cent in the 12 months to March 2016 (in trend terms).

Productivity growth rates are best measured in

growth cycles. According to the Productivity Commission’s PC

Productivity Update (April 2016) labour

productivity across the market sector has averaged 2.3% per annum in the period

between 2007–08 and 2014–15. The last, complete cycle occurred between 2003–04

and 2007–08 when annual average labour productivity growth was 1.6%.

Figure 8: Annual labour productivity growth

Source: ABS, National accounts, cat.

no. 5206.0, Table 1, Trend.

The Productivity Commission found the relatively strong

growth in labour productivity recorded for mining in 2014–15 was driven by a

substantial contraction in labour inputs as well as strong growth in output.

The Commission attributed the improvement in both labour productivity and multi‑factor

productivity in mining to the transition from the investment phase to the

production phase.

Further reading

C Kent, Cyclical and Structural Change in the Labour Market, Address by the Assistant Governor (Economics) Reserve Bank of Australia, Reserve Bank of Australia website, 16 June 2014.

J Healy, ‘The Australian labour market in 2015’, Journal of Industrial Relations, 58(3), June 2016, pp. 308–323.

PC Productivity Update April 2016.

Back to Parliamentary Library Briefing Book

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth Coat of Arms, and to the extent that copyright subsists in a third party, this publication, its logo and front page design are licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia licence.